Budget 2022: What’s in it for freelancers and sole traders?

A week ago, the federal government handed down its 2022 post-pandemic (or pre-election) budget. Although it wasn’t the most aspirational budget, it did address some key points that will help us move forward after a very frustrating couple of years. Rounded co-founder Nicholas Beames looks at how it will impact freelancers and sole traders.

Tech Boost

Small businesses will have access to a 20 percent tax deduction for expenses and depreciating assets associated with digital uptake.

For every $1 you invest in tech, like Rounded, you can claim $1.20 as a tax deduction. For freelancers and sole traders, it could save a few hundred dollars at tax time.

Skills and training boost a budget boon for business

Small businesses will have access to a 20 percent tax deduction for the cost of external training courses delivered to their employees by providers registered in Australia.

Like the Tech Boost, you can up-skill and claim 120% of the expense as a tax deduction. A modest benefit, but it all adds up.

COVID recovery support

The Government has pledged $146 million to support the recovery of the Australian tourism sector in response to the pandemic impact, including further assistance for travel agents.

An additional $38 million will be allocated to the arts sector, including independent cinemas, to assist with its recovery.

Fuel tax cut

The budget provides for halving the excise on petrol and diesel from 44 cents per litre to 22 cents per litre for six months.

SME procurement

New procurement rules will make it easier for SMEs to secure Government contracts.

Under the proposed changes, government departments will be required to split up significant projects to give smaller contractors a greater chance of competing.

There will also be more opportunities for SMEs, freelancers, and sole traders in the defense arena, with the department, permitted to purchase directly from SMEs or use tenders limited to SMEs for contracts worth up to $500,000.

Improved internet

$480 million will extend the coverage range from towers and increase the speed of services to customers, particularly in rural areas.

Mental health support for small business owners

The Australian Government has renewed funding for a critical mental health program tailored to small business owners.

An additional $4.6 million in funding will ensure Beyond Blue’s New Access for Small Business Owners program can expand and continue to assist small business owners who need mental health support.

Small Business Debt Helpline gets budget funding boost

$2.1 million has also been allocated to extend the Small Business Debt Helpline for 2022.

If you or anyone else you know would like to talk to a specialist about small business debt you can call any time on 1800 413 828.

In summary, for freelancers and sole traders, there isn’t much in the way of big headline initiatives however there are certainly a couple of things that will help to ease some of the burdens at tax time as well as some increased support for skills training, debt management, and mental health support.

Cover Photo by Mathieu Stern on Unsplash

Join newsletter

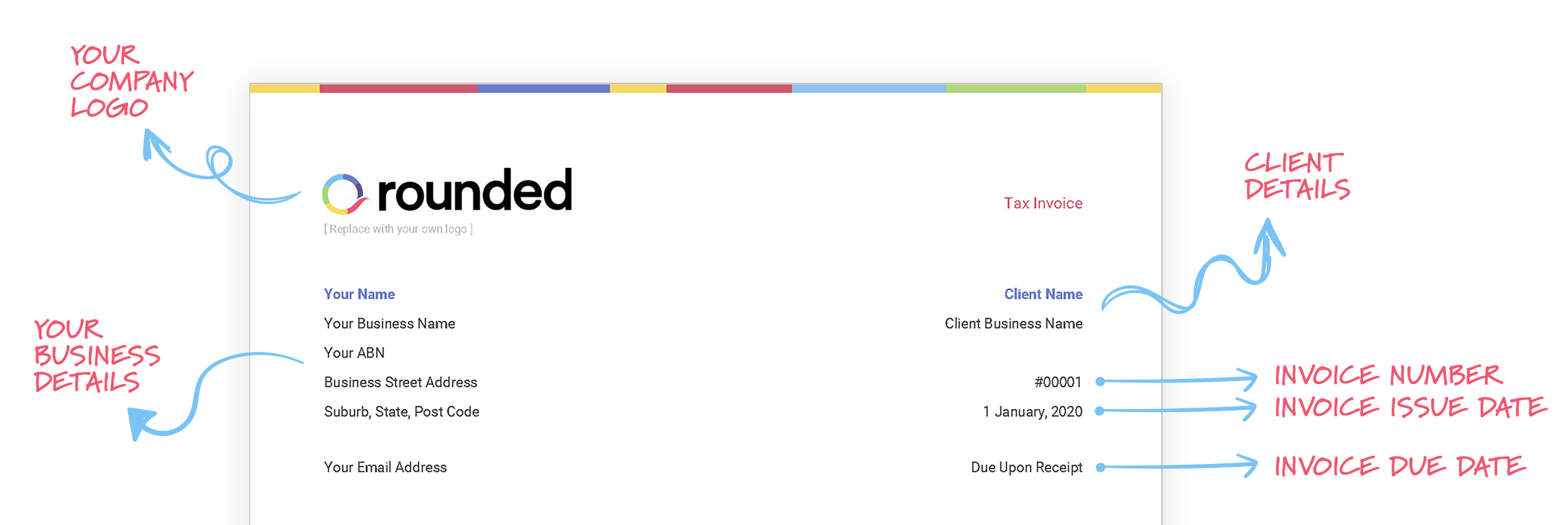

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.