Get AI-powered accounting without giving up control

No need to create a new bank account or change how clients pay you. Rounded is easier, more flexible, and more affordable than Thriday.

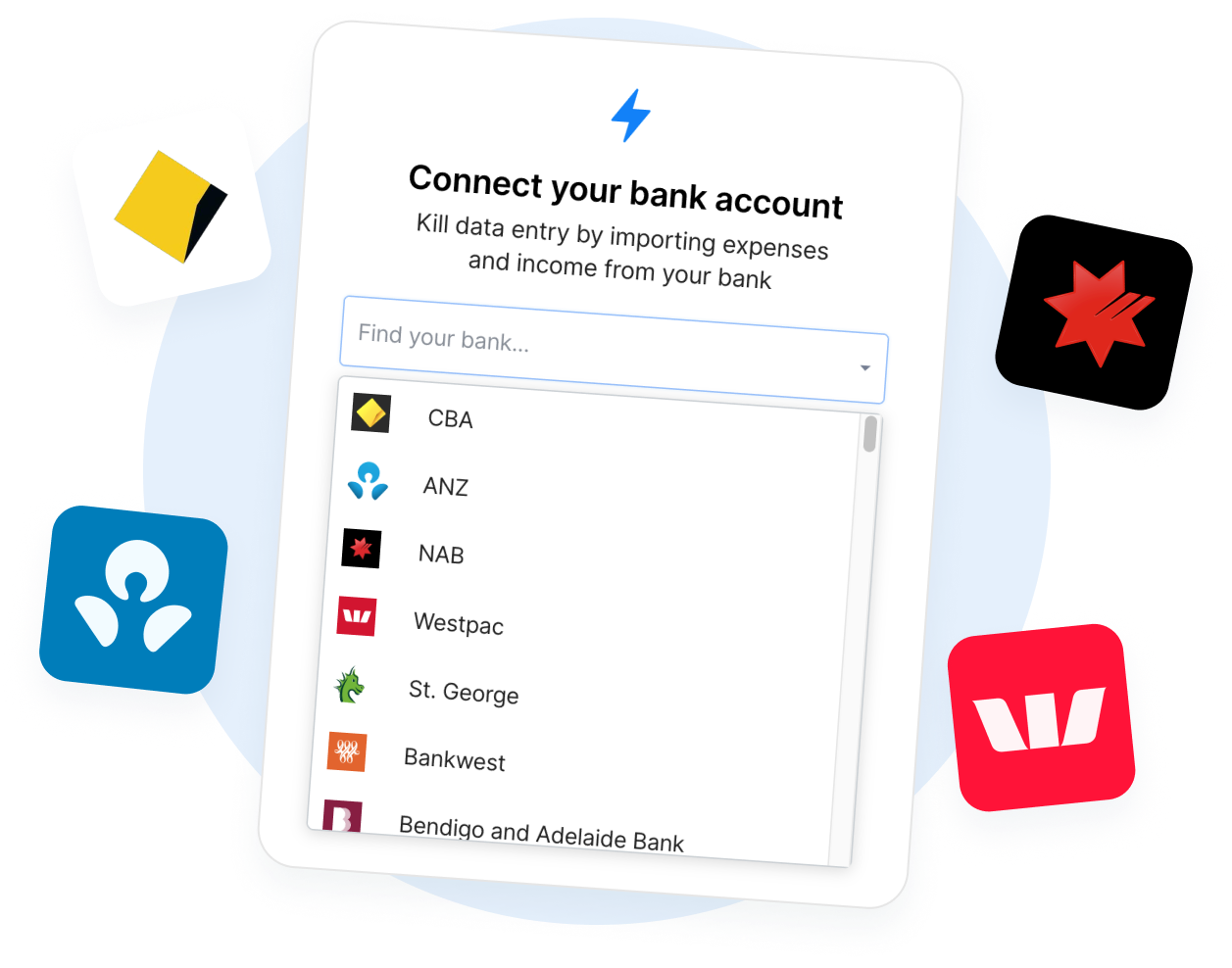

Track income and expenses with any bank account

Rounded connects to 130+ financial institutions. Our secure Bank Feed is simple to set up and imports transactions in seconds.

Thriday requires you to open and only use their bank account. If you use other accounts, you’ll have to add transactions manually, which is time-consuming and prone to errors.

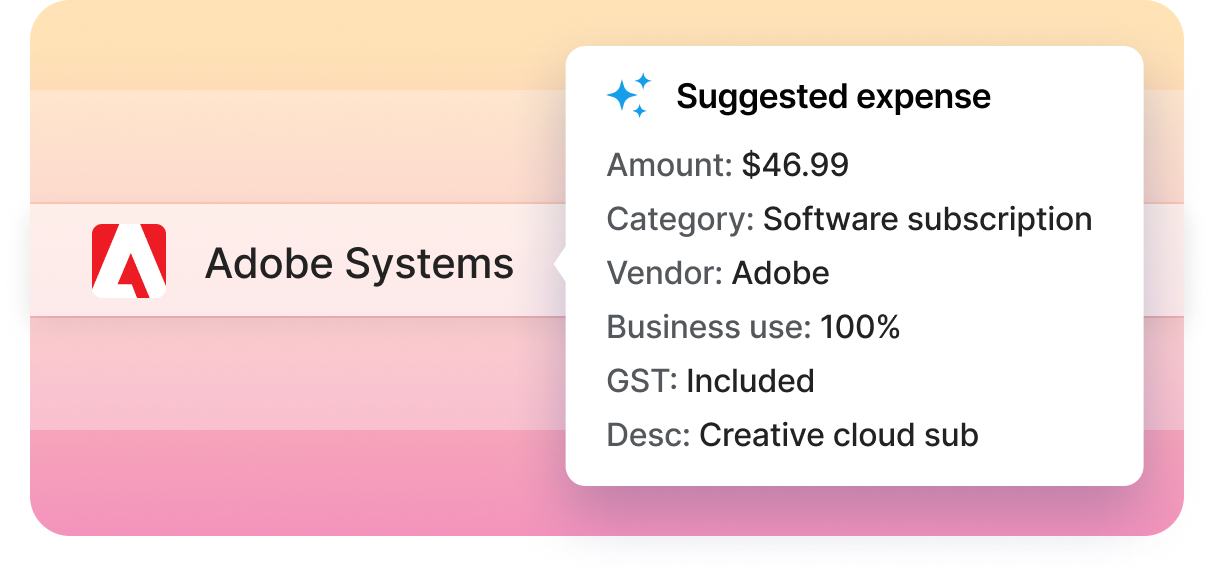

AI reconciliation without compromise

Thriday’s excessive reliance on AI makes it hard to spot errors and even harder to correct them, as you’ll be unable to fix your own data without someone from their team.

Rounded leverages AI to cut out unnecessary work while keeping you in the driver’s seat as a safeguard. You’ll have the chance to quickly review every transaction for accuracy and make changes if needed.

Master Rounded in minutes

Your client will have received your first Rounded invoice before you've finished signing up for a Thriday bank account.

Need help getting set up? Our team is always ready with helpful live chat support, with an average response time of 30 seconds.

You’re in full control of your banking data

We’re the first Australian accounting tool to use Open Banking, which allows you to choose what data to share and manage permissions directly through your bank. This means you don’t have to share your credentials with us.

Open Banking is regulated by the Australian Government and ensures your information is protected by the Rules of the ACCC.

Why choose Rounded over Thriday?

|

|

|

|

|---|---|---|

|

More ways to get paid

|

Get paid into any bank account and track income from ecommerce and subscriptions via Stripe feed

|

Can only use a Thriday bank account

|

|

Time and project tracking

|

Record every second spent on a project and instantly convert it to an invoice when finished

|

Pay for another app and waste time going back and forth when invoicing

|

|

Work with any accountant

|

Give an accountant secure access to your data via our Accountant Portal

|

No easy way (unless you pay +$88/mo to work with Thriday’s accountants)

|

|

Claim expenses

|

Snap pictures of receipts on the go and attach to expenses

|

Only $30/mo plans and up

|

|

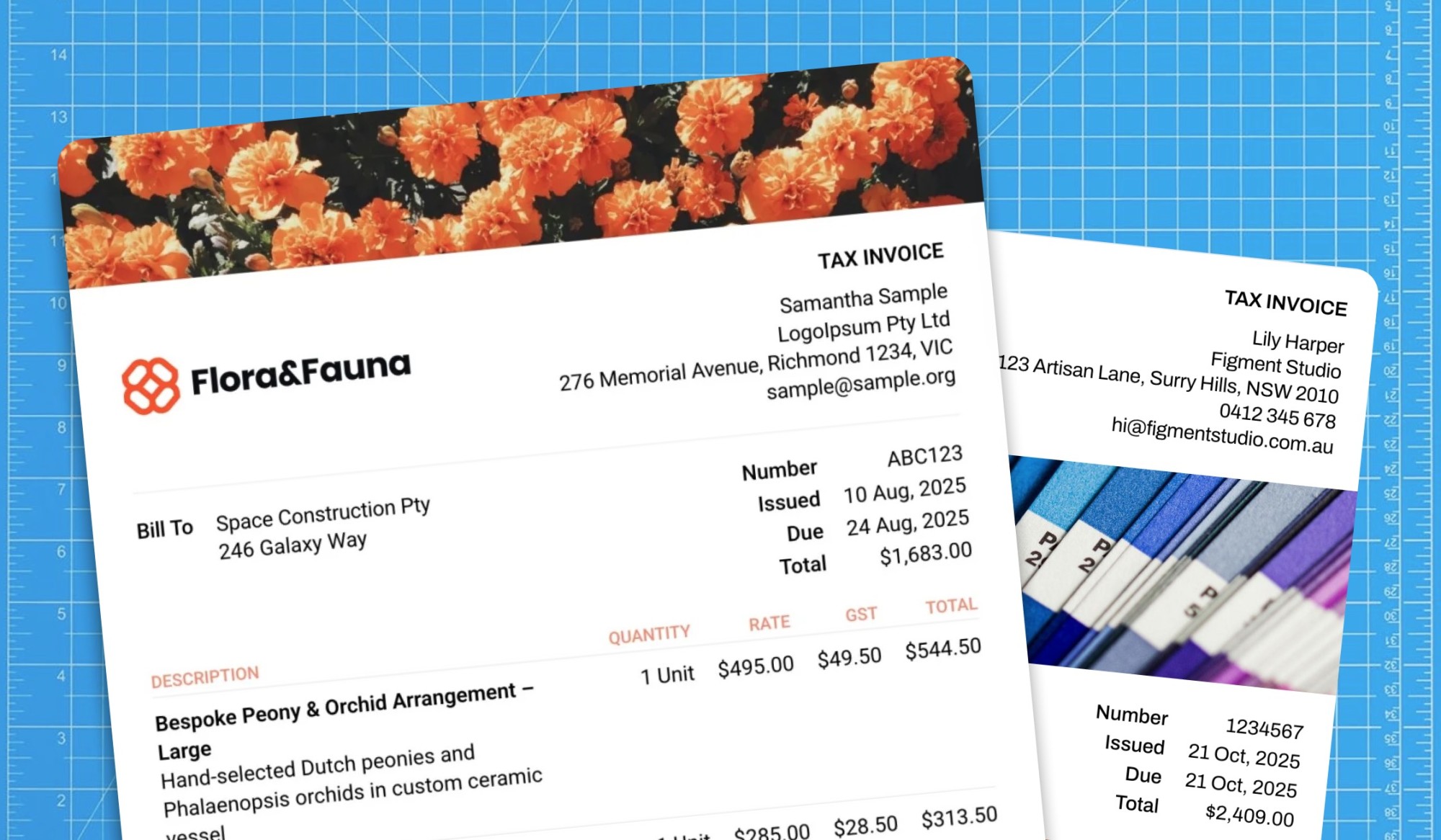

Customisable quotes and invoices

|

Change layout, colours, fonts, and labels. Create reusable templates for different clients or services.

|

One generic, stale invoice

|

|

Simple pricing

|

Every feature is available in one of our two affordable plans, so you can choose the plan that suits you

|

Complicated plans that focus on upselling users on their accounting services

|

|

Try risk-free

|

Cancel anytime with one click and take your data with you, no questions asked

|

Must sign up for a bank account during trial and fill out tedious forms to cancel

|

|

Control over your data

|

Try Rounded Free →

Simply ask us to destroy your account, and we’ll remove your data from our systems

|

Thriday owns your data and stores it for at least 7 years, with no option to delete

|

- More ways to get paid

-

Rounded:Get paid into any bank account and track income from ecommerce and subscriptions via Stripe feed

-

Thriday: Can only use a Thriday bank account

- Time and project tracking

-

Rounded:Record every second spent on a project and instantly convert it to an invoice when finished

-

Thriday: Pay for another app and waste time going back and forth when invoicing

- Work with any accountant

-

Rounded:Give an accountant secure access to your data via our Accountant Portal

-

Thriday: No easy way (unless you pay +$88/mo to work with Thriday’s accountants)

- Claim expenses

-

Rounded:Snap pictures of receipts on the go and attach to expenses

-

Thriday: Only $30/mo plans and up

- Customisable quotes and invoices

-

Rounded:Change layout, colours, fonts, and labels. Create reusable templates for different clients or services.

-

Thriday: One generic, stale invoice

- Simple pricing

-

Rounded:Every feature is available in one of our two affordable plans, so you can choose the plan that suits you

-

Thriday: Complicated plans that focus on upselling users on their accounting services

- Try risk-free

-

Rounded:Cancel anytime with one click and take your data with you, no questions asked

-

Thriday: Must sign up for a bank account during trial and fill out tedious forms to cancel

- Control over your data

-

Rounded:Simply ask us to destroy your account, and we’ll remove your data from our systems

-

Thriday: Thriday owns your data and stores it for at least 7 years, with no option to delete

Fantastic accounting app! It's such a stress relief! The invoicing system is simple, easy and just works! Connection to my bank account is flawless and it makes reconciliation a breeze. I highly recommend this app for any small business!

The way Rounded works just makes sense to me. The invoices are beautifully designed, the payment tracking makes sense, and the overall design of both the website and the app are delightful to use. Wow, did I just call an accounting tool delightful?

Perfect app for sole traders in Australia. Covers everything. They have set out to make it as straightforward yet efficient as possible. Response times are fast if you have any questions. Subscription price is very competitive. Highly recommend.

Explore more Rounded features

-

Easy Invoicing →

Simple, professional invoicing on mobile and desktop. Customise your templates, receive online payments and set automatic reminders for your clients. -

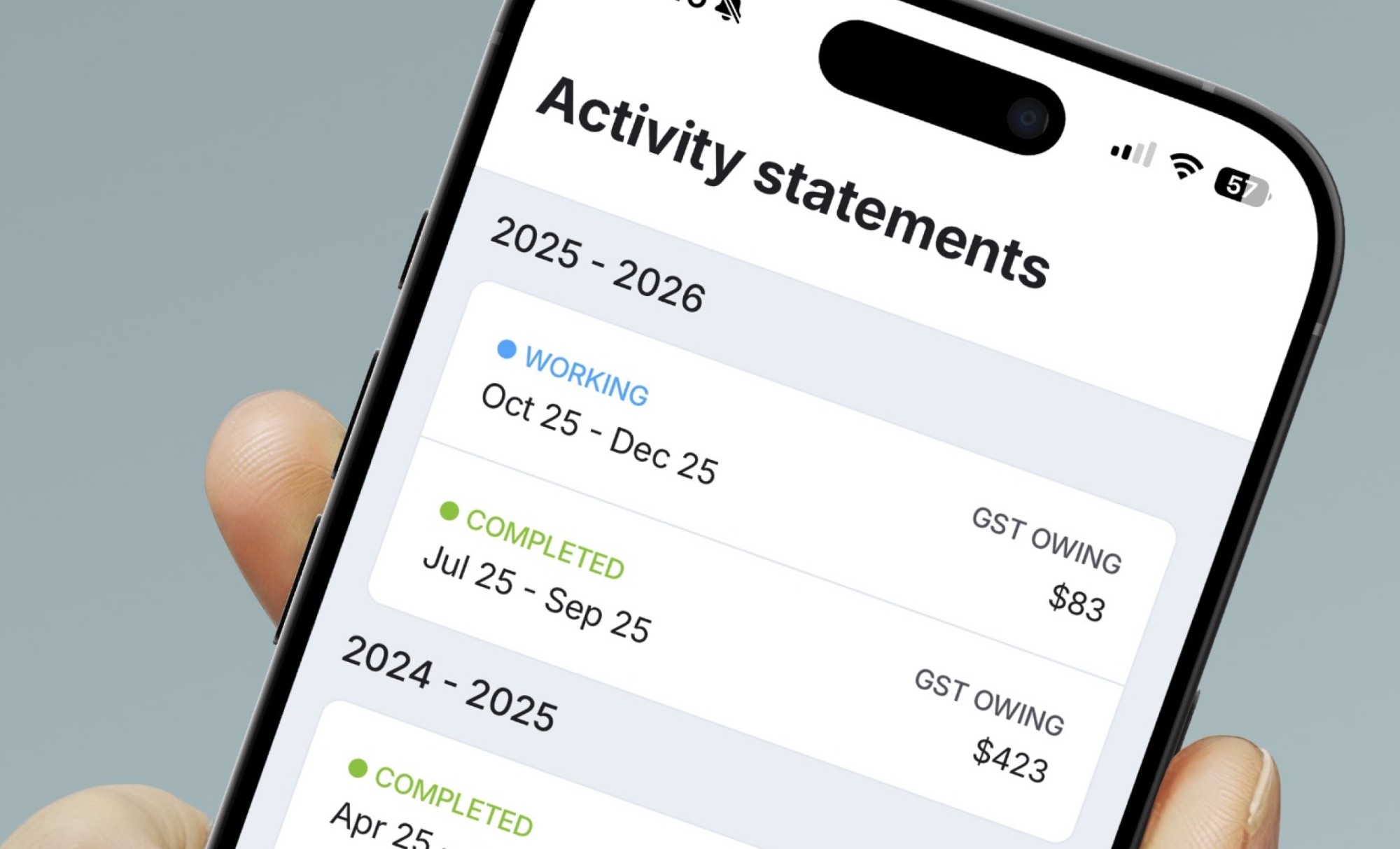

Stress-free tax reporting →

Always know how much tax you’ll pay with our built-in calculator, designed specifically for Australian sole traders. -

AI-powered expense tracking →

Easily track your business expenses and store receipts digitally. Securely connect your bank and let our AI do the data entry. -

Built-in time tracking →

Accurately capture every second spent on work – whether you’re in your home office, on-site with a client, or out and about.

Try Rounded first

Frequently Asked Questions

Definitely not. However, we’ve found a lot of sole traders value working with an accountant or bookkeeper, especially at tax time. Because of this, we’ve made it super easy for you to securely offer access to your Rounded account via the Rounded Accountant Portal. There's no cost to your accountant for using this feature, as it's included with every Rounded subscription.

You can easily snap pictures of receipts using our mobile app and attach them to expense records. You can also upload files from your computer when using the desktop version of Rounded.

We partner with Basiq, an Australian company based in Sydney, to provide bank feed data. Login details are not kept in the Rounded technical environment and the financial data shown inside the app is “read-only”, so there's no way to initiate any kind of payment or transfer. We also offer multi-factor authentication to help keep your data totally secure.

Nope! Unlike Thriday, you can use Rounded on your own terms.

Don't want to connect your bank account? Simply enter expenses manually or even bulk import from an existing spreadsheet – our support team will be happy to assist.

The Bank Feed is one of the features included in our Pro subscription, along with GST tracking, BAS, and unlimited invoice templates.

We offer data migration services to help you transfer records from other accounting software or spreadsheets. Get in touch with our team to find out more.