Newsletter - July 2024

This month, we spoke to Honni Hayton, a counsellor who specialises in helping business owners, to get her best tips for protecting your mental health and wellbeing in the second half of 2024.

Article contents

− +- Introduction

- 🧠 Protecting Your Mental Health as a Solo Business Owner

- 💡Tax Tip of the Month with Lauren Thiel, Accountant for Creatives

- Signing Up for Rounded Just Got Even Easier!

- 📈 How to Generate Reports with Rounded

- 💰 What Does Caring About Your Freelance Finances Get You?

- 🎉 Congratulations to the Rounded Customer Success Team

- 🧠 More Helpful Resources for your Solo Business

Whether you’ve been with us for a while, or are one of the hundreds of business owners who have signed up in the last month, we’re glad we can support you on your solo business journey.

But before we jump in, a bit of housekeeping:

Your dashboard has been reset as of July 1st (in case you haven’t seen our announcement on socials). You can still access all your past data – if you need a hand, just reach out.

For those of you looking to do your tax early, we’re including a quick guide to Rounded reports below.

Enjoy!

— The Rounded Team

🧠 Protecting Your Mental Health as a Solo Business Owner

This month, we sat down with Honni Hayton, an expert in helping business owners manage work-life balance and the pressures of being self-employed.

Here's a quick look at our top takeaways:

1. Setting better boundaries between work and personal life

Better work-life balance is all about putting boundaries in place – and keeping them!

Designate specific work hours and stick to them. For example, Honni works Monday to Thursday, 9am to 5pm, and uses Fridays for business tasks.

Create a clear physical separation between work and personal life. If you work from home, set up a dedicated workspace, even if it’s just a corner of a room.

Use two phones if possible—one for work and one for personal use. If that’s not feasible, set strict boundaries on your phone usage, like turning off notifications outside of work hours.

2. Dealing with stress/anxiety caused by uncertainty and unsteady income

Sole traders are dealing with a lot of uncertainties about the future. Here's some of the ways Honni recommends

Distinguish between stress (challenges with a specific external cause) and anxiety (internal fears without specific causes).

Manage stress by seeking help for external issues, like consulting a financial planner.

Address anxiety through mindfulness, relaxation exercises, and professional counseling.

Focus on the things you can control – like setting better boundaries around work or spending more time networking and building up your business profile.

Acknowledge but don't dwell on uncontrollable factors, such as interest rates.

3. Practicing real self-care

Self-care is more than taking a bubble bath or occasionally going to a day spa. To practice real, holistic self-care, Honni recommends the STEPS approach:

Social: Schedule regular social activities and set boundaries to protect your time.

Thinking: Practice positive affirmations, mindfulness, and continuous learning.

Emotional: Engage in hobbies and activities that bring you joy, and make time for these regularly.

Physical: Prioritise regular exercise, healthy eating, and good sleep habits.

Spiritual: Engage in spiritual practices that resonate with you, like meditation, prayer, or spending time in nature. Participate in community activities to enhance your spiritual well-being.

See our interview for more information on these, as well as tips for:

Preventing burnout

Staying motivated in times of low inspiration

Dealing with imposter syndrome

💡Tax Tip of the Month with Lauren Thiel, Accountant for Creatives

Work with overseas clients, or want to do so in the next financial year? Here's what you should know about tax:

Australian tax residents get taxed on worldwide income, so you need to include in your tax return all relevant income even if your customers are overseas.

You might collect money from them in a different currency, but everything needs to be reported to the ATO in AUD$. They have handy exchange rates on the ATO website you can use to help you with the currency translation too.

International tax is a bit tricky at times so always best to check in with your accountant.

Want more tax tips? Check out the Q+A we did with Lauren here.

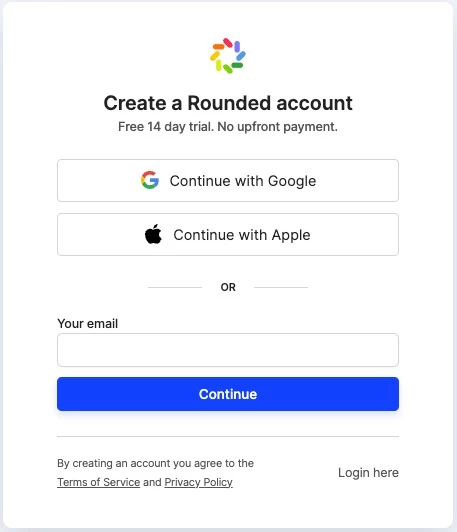

Signing Up for Rounded Just Got Even Easier!

With our new update, you can now use your Google or Apple account to sign up for Rounded in seconds.

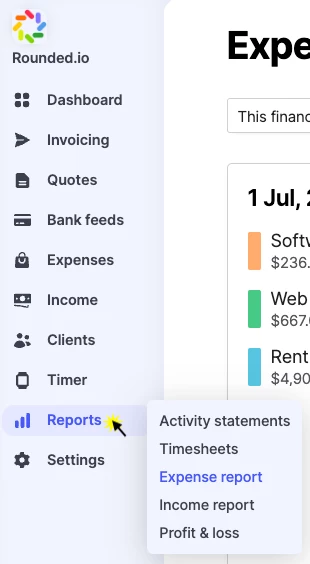

📈 How to Generate Reports with Rounded

Doing your own tax return this year? Rounded automatically prepares the reports you need.

Reports are based on the data in your Income and Expenses section and are automatically updated as you add or change records.

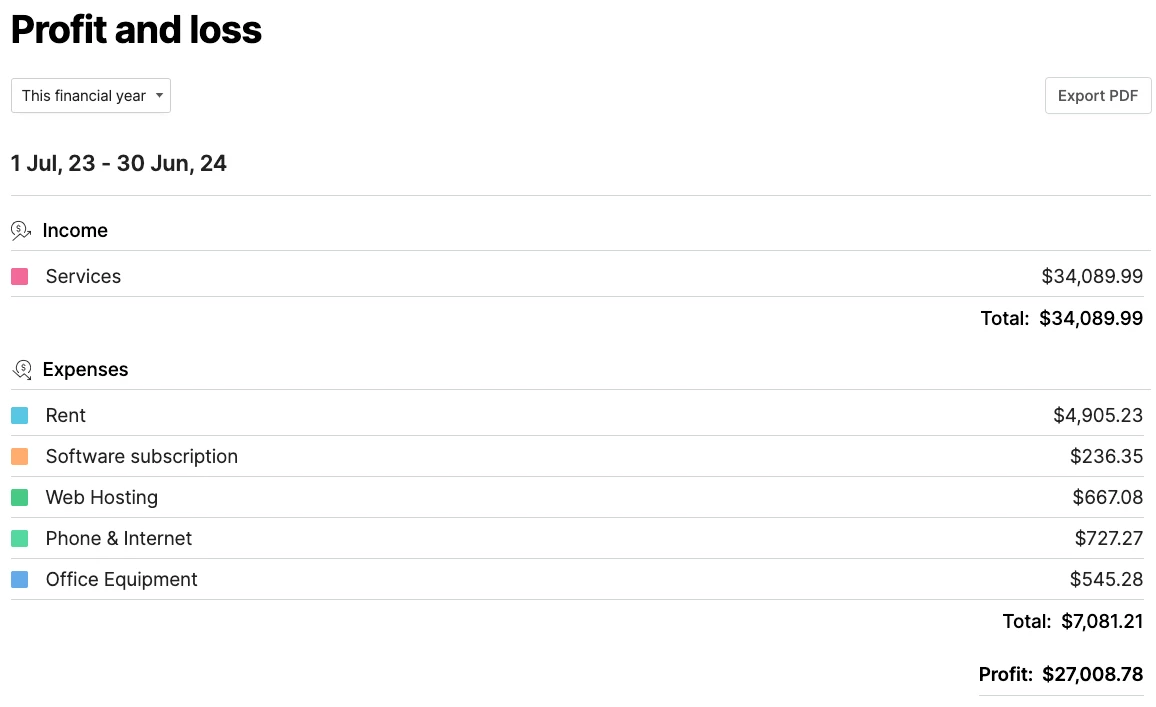

The Profit & Loss report provides a quick overview of your income, expenses, and overall profit. It will automatically display data from the current financial year, so adjust as needed.Profit and Loss Report

You can easily download your report by clicking Export PDF.

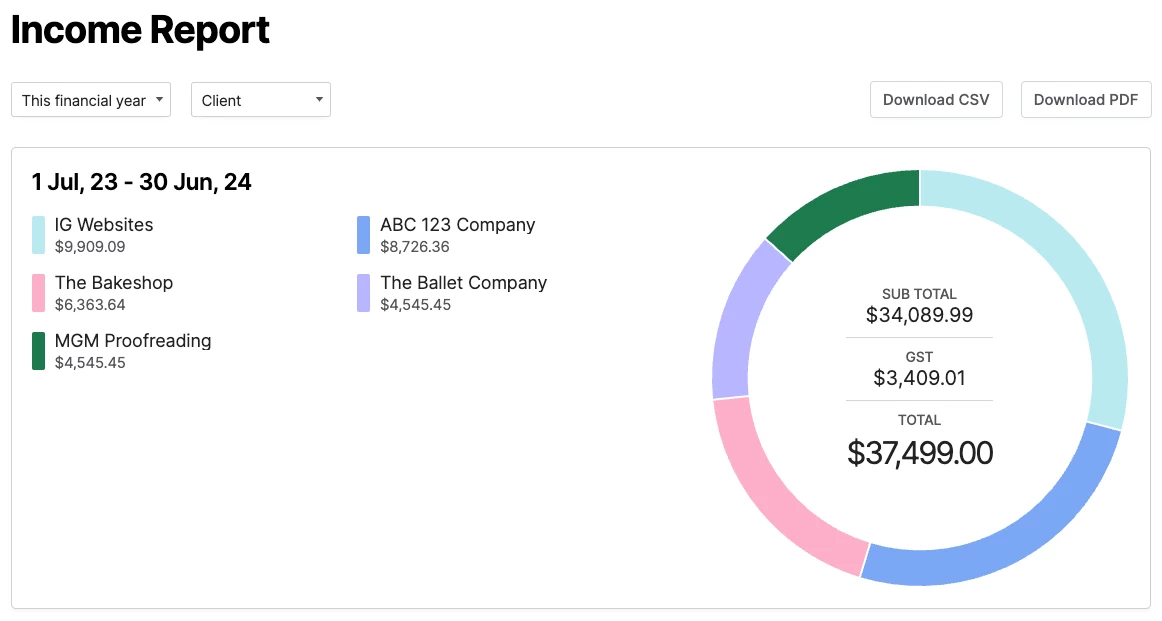

If you’d like a more detailed view of income and expenses over the 2023-24 Financial Year, use our Income and Expenses reports.Rounded's Income Report

💰 What Does Caring About Your Freelance Finances Get You?

We partnered with Rebekah Lambert to get up close and personal with her freelance finances over the last 6 months.

Here's what you can learn from her journey 👇

🎉 Congratulations to the Rounded Customer Success Team

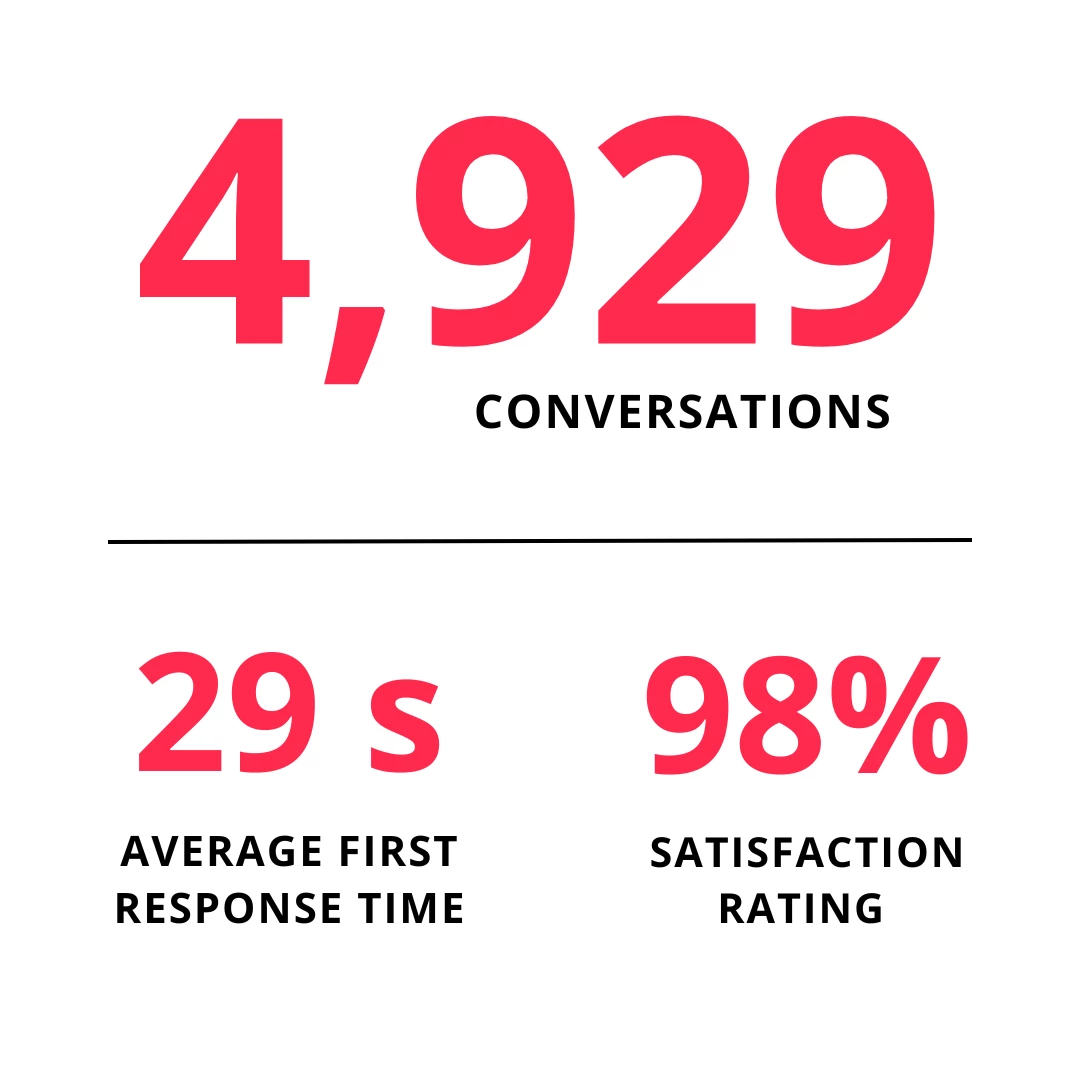

Thanks to the amazing work of Michelle and Roxanne, we've achieved an outstanding 98% satisfaction score over the last 12 months!

Giving you the best user experience and support is our top priority – and it's because of the dedication of these two that we can constantly deliver.

If you ever need a hand, just reach out to Michelle or Roxanne inside the app – they'll typically respond in about 30 seconds ⚡️

📣 Hear From the Rounded Community

Not signed up to Rounded yet? Start your free trial now.

🧠 More Helpful Resources for your Solo Business

Get a step-by-step guide to doing your sole trader tax

See how Rounded works in our free weekly masterclass

Tips for marketing your business when you do different types of work

Join the Business Tides community for free this July

Contents

- Introduction

- 🧠 Protecting Your Mental Health as a Solo Business Owner

- 💡Tax Tip of the Month with Lauren Thiel, Accountant for Creatives

- Signing Up for Rounded Just Got Even Easier!

- 📈 How to Generate Reports with Rounded

- 💰 What Does Caring About Your Freelance Finances Get You?

- 🎉 Congratulations to the Rounded Customer Success Team

- 🧠 More Helpful Resources for your Solo Business

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

.jpg)