Newsletter - November 2023

As we near the end of 2023, now’s the time to prep your business so you can take a well-deserved break! We’ll dive into how you can take a guilt-free holiday this Christmas by ensuring clients are taken care of and everything keeps running smoothly.

Article contents

− +- Introduction

- Also in this newsletter:

- 💡 Featured Advice: How to take a real break this Christmas

- 📍 Prepping Your Finances for the Holidays with Lauren Thiel, the Accountant for Creatives

- ✨ New Rounded updates

- 📈 October Poll Results: Do you use 2FA?

- ✨ Feature Highlight: Invoice Dashboard

- 🧠 The Rounded Round-Up

- 🗞️ Want to see your business featured in our next newsletter?

Also in this newsletter:

How much time should you take off at Christmas, and how do you prepare? Top tips from other solo business owners

Looking after the financial side of your business and budgeting for the holidays with Lauren Thiel, the Accountant for Creatives

More great Rounded updates from our co-founder Grant

How to use Rounded’s invoice dashboard to stay on top of client payments

A roundup of some of our favourite reads and resources from the last month

💡 Featured Advice: How to take a real break this Christmas

The best part about running your own business is being able to set your own hours. But when it comes to the holidays, it can be difficult to take the time off – especially if you're worried about what will happen in your absence, or how clients will respond.

Here’s 3 tips to help you prepare:

1) Let your clients know you’ll be on holiday, and set clear expectations around availability

Give at least one month’s notice – more if you can. If you haven’t yet, make a point this week to shoot off a quick email to all your clients letting them know:

When you start your holiday, and when you’ll be back.

Your availability during this period. Will you be checking emails, or will you be switching off completely? We recommend the latter, but it’s important to clarify for clients.

How will your holiday affect delivery? Let them know when to expect deliverables and when they’ll need to provide feedback. There may be no change – for example, if you take care of a client’s social media, let them know that posts will be going out on the same schedule.

2) Batch deliverables in advance

Depending on what you do, you may be able to prep client work in advance. If possible, batch your deliverables well before your break so there’s no disruption to the client (or your cash flow).

3) Tie up loose ends

This way, you won’t have any open tabs in your head while you’re trying to enjoy your downtime, and you don’t have to worry about forgetting anything when you resume work in 2024.

It helps if you automate everything you can – like your social media posts and other admin.

Things you might focus on:

Send any outstanding invoices. You can use Rounded to easily see which invoices still need to be sent.

Log any outstanding expenses and capture any receipts, so you start fresh in 2024. With Rounded, this only takes a few minutes.

Wonder how other freelancers and sole traders prep for a holiday? Check out our roundup of the best advice from business owners like you on our Instagram👇

📍 Prepping Your Finances for the Holidays with Lauren Thiel, the Accountant for Creatives

As Christmas sneaks up on us once again, I like to plan my holiday break by beginning to communicate this with staff and clients (not that many people are thinking about tax then), and plan ahead for when and how I stay on top of bookkeeping.

It's a good time to take a break and remember that resting is an important part of creating sustainable energy. I find taking a real break from work and emails gives my brain space to be creative and strategic again.

In terms of budgeting personally, it is easier to put a little bit aside each week rather than using a credit card or Afterpay for gifts. We all know times are tough, so think about buying local, from other small businesses (you will make their day!) or even making your own gifts. They can be more affordable and often more special.

✨ New Rounded updates

1) Dashboard chart

The primary chart on the dashboard has been given a refresh with plenty more date ranges to choose from, a new option to chart your overall profit, and the ability to directly compare specific date ranges.

Keep your eye on the dashboard over the next week or so – we'll be giving it a fresh coat of paint!

2) Mobile apps

There are new versions of the Rounded app available on the App and Play Stores, which fix a few pesky bugs:

On iOS, attachments to expenses now upload correctly and in the right orientation.

When starting the app on Android, any music, videos or podcasts will continue to play uninterrupted.

We'll be making plenty of handy interface improvements to our mobile experience over the coming months!

What we're working on

We're pleased to say the top two items on our feature request board are currently underway!

Recording superannuation contributions for tax deductions

First steps towards enabling subscriptions (automated billing) for your clients!

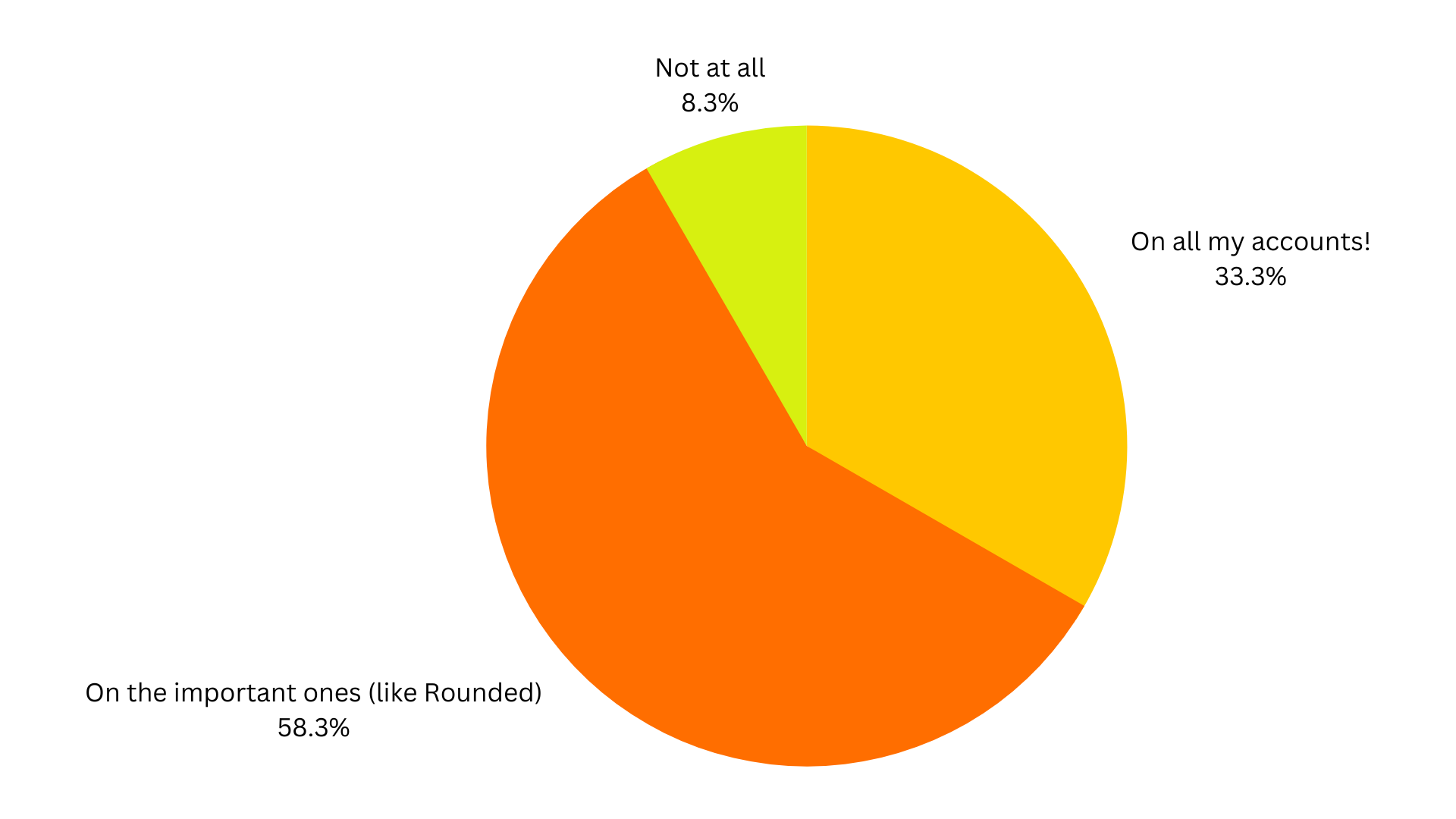

📈 October Poll Results: Do you use 2FA?

Good news – over 90% of you are keeping your businesses safe by using 2FA on some or all accounts!

Considering only 33% reported using 2FA when we asked last year, this is a great improvement 👏

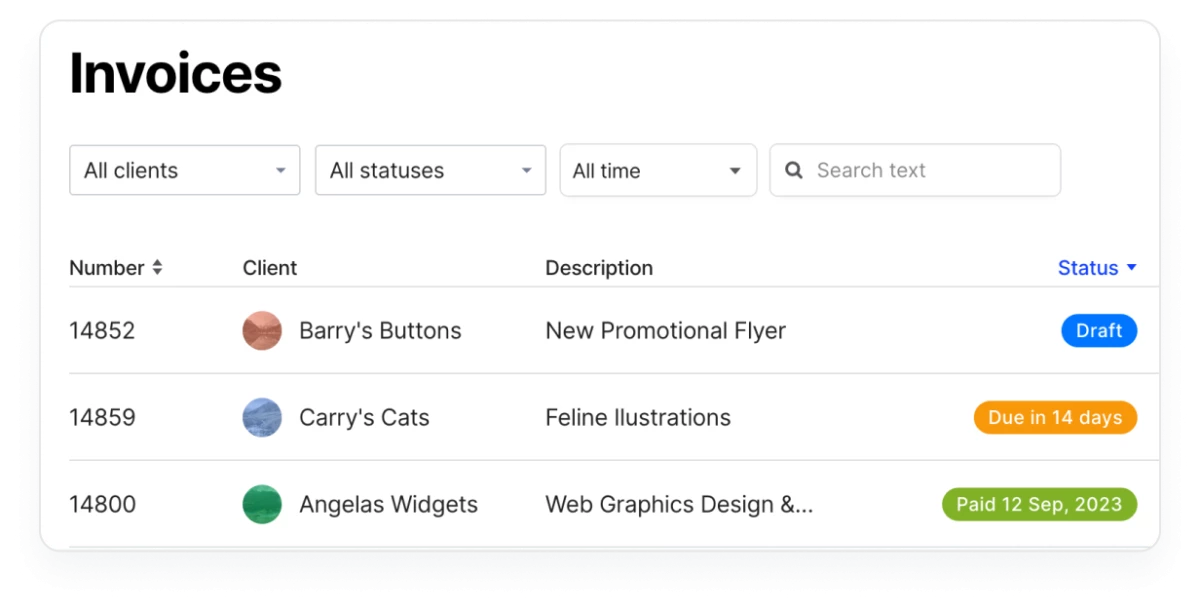

✨ Feature Highlight: Invoice Dashboard

When you have a lot of different projects on the go, it can be difficult to remember who’s paid what. With the Invoice Dashboard, you can easily see…

Which invoices need to be sent

Which invoices have been seen by the client, and still need to be paid

Which invoices have been paid, and which ones are overdue

🧠 The Rounded Round-Up

Our friend Rachel Smith reports on 30 lightbulb moments from the Content Byte Summit

How you can leverage AI as a freelance writer

Freelance designer Jeremy Mura shares his top lessons after 10 years in design

From the Rounded archives, just in time for those who are thinking about raising their rates 👉 How to set the right price for your freelance business

🗞️ Want to see your business featured in our next newsletter?

Our monthly newsletter goes out to 8,000+ freelancers and sole traders across Australia. Apply to be next month’s Featured Customer here.

Contents

- Introduction

- Also in this newsletter:

- 💡 Featured Advice: How to take a real break this Christmas

- 📍 Prepping Your Finances for the Holidays with Lauren Thiel, the Accountant for Creatives

- ✨ New Rounded updates

- 📈 October Poll Results: Do you use 2FA?

- ✨ Feature Highlight: Invoice Dashboard

- 🧠 The Rounded Round-Up

- 🗞️ Want to see your business featured in our next newsletter?

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

.jpg)