End of Financial Year checklist for freelancers and sole traders

End of financial year doesn’t have to be stressful—it just takes a little planning and preparation. Here’s everything freelancers need to do to wrap up their financial year with no loose ends.

Article contents

− +- Introduction

- 1. Know your EOFY dates and the basics

- 2. Pull together all of the information you need

- 3. Make sure you’ve deducted everything you can

- 4. Decide if you want to bring forward expenditures, or make donations or super contributions

- 5. File your tax claim when you’re ready

- 6. Plan ahead to make next EOFY even easier

-p-1600.jpeg)

It’s easy to feel anxious about the End of Financial Year, especially if you are running your own business. Without an employer to guide you, it’s up to you to make sure you submit the right tax payments, at the right time, to the right place.

You can take a deep breath—we’ve put together this checklist to help freelancers and sole traders manage tax time, with tips on how to maximise your expenses and prepare for next year.

Note: You can do a lot of the work preparing for EOFY yourself, but it’s always a good idea to have a tax accountant look over everything before you submit your information to the ATO.

1. Know your EOFY dates and the basics

First things first, let’s make sure we are on the same page regarding the basics of EOFY.

When is End of Financial Year?

Australia’s financial year ends on June 30th, every year.

The new financial year starts on July 1st, and runs for the next 12 months.

For business owners, EOFY is when you need to start finalising all of the financial details from the past 12 months.

You’ll need to report all your business income and expenses, and make sure you’ve done all of your paperwork for your quarterly tax instalments. (Here’s our full guide on managing quarterly PAYG instalments.)

You can lodge your final tax return for the year any time between July 1st and October 31st, so you have some time to get everything in order after the official end of the financial year.

2. Pull together all of the information you need

The most time-consuming part of EOFY is pulling together all of the data you need to file. If you’re a Rounded user, you’re in luck—our automated reports, along with our easy expense-tracking feature means you should be able to pull together all of this info with just a few clicks.

Here’s the minimum you’ll need to report your taxes, and where to find them in Rounded:

Your business name and ABN (found on your invoices)

Your Tax File Number (On most correspondence from the ATO. More info HERE)

If you are GST registered; your Banking Activity Statements (BAS) (available in Rounded reporting)

Your total income from the year (available on your Rounded dashboard)

Your total expenses from the year (available in your the expenses tracker)

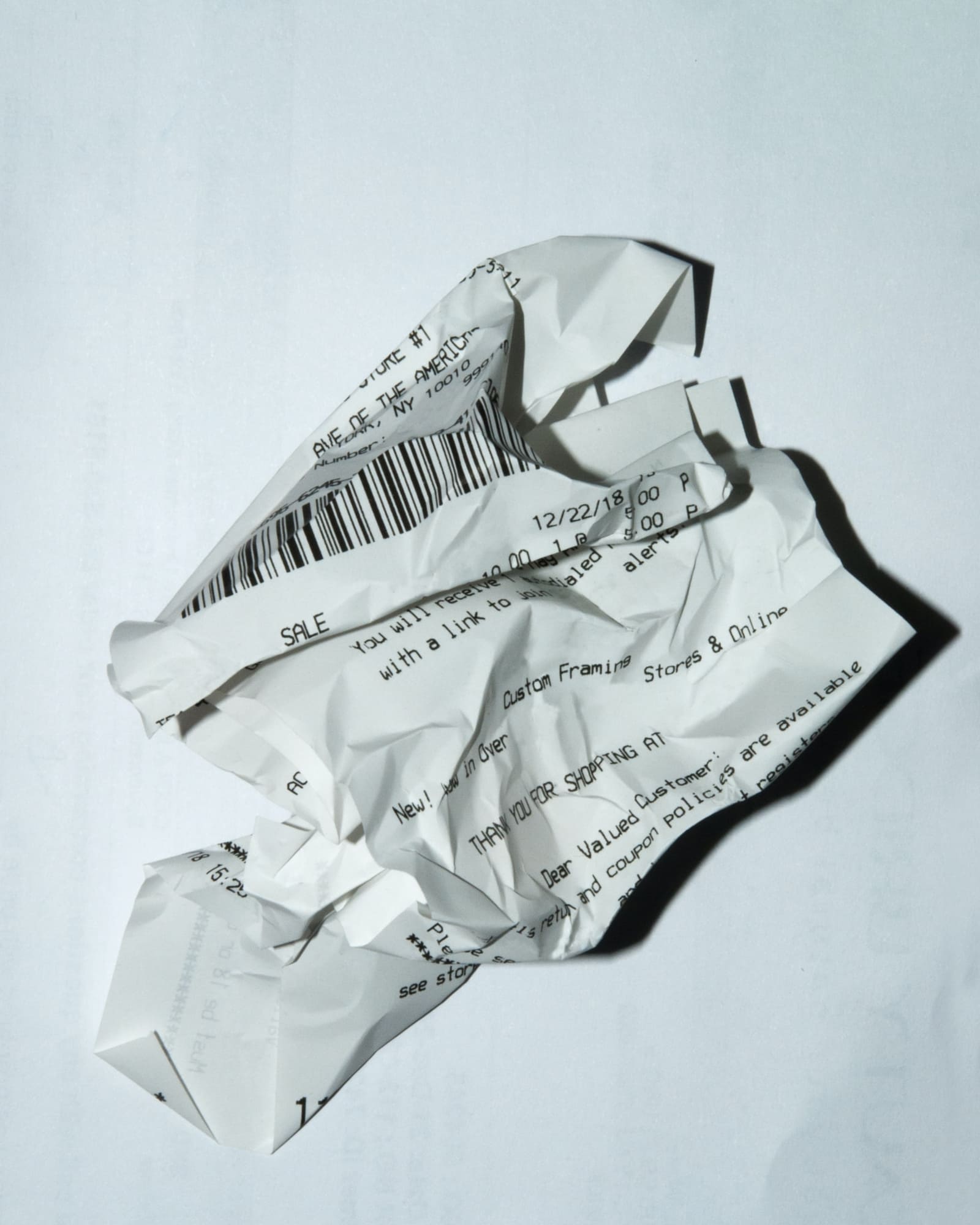

Receipts from your business expenses (these can be saved to your expense tracker)

Once you’ve gathered all of those pieces of information together, you will be much closer to filing your EOFY taxes.

3. Make sure you’ve deducted everything you can

Deducting your businesses expenses is one of the best ways to save money as a freelancer or sole trader. Before you file your taxes, it’s a good idea to make sure you’ve deducted everything you possibly can, to minimise your chances of having to pay more taxes than expected.

If you aren’t sure whether you’ve made all the deductions you can, check out this article: What can you claim on tax? A guide for freelancers

While you’re going through this process, it’s a good idea to make sure you’ve got all of your receipts on hand—either the physical receipts, or the images of them you’ve uploaded into Rounded. You won’t need to show evidence of these when you file, but if tax office has any questions about your deductions, you’ll need to have receipts organised and easily accessible.

It’s always a good idea to run your deductions by a tax accountant before you finalise them. A professional can make sure your deductions are accurate, and you’ve explored every avenue for finding business expenses.

4. Decide if you want to bring forward expenditures, or make donations or super contributions

If you think you’re going to have a big work-related expense in the near future, like buying a new computer, you may want to make that purchase before June 30th rather than after July 1. This means you’ll see its impact on this year’s tax bill, rather than a year from now.

In fact, a lot of businesses offer EOFY sales for this reason—they discount their products to encourage business owners to buy before the end of June. So it may be a good idea to shop around and see if you can find a deal.

In a similar vein, if you plan on making any charitable donations or contributions to your superannuation fund, it’s not a bad idea to do it before the end of the financial year, if you have the funds. These can be counted as deductions and can keep your tax bill lower. (Be sure to read our guide to superannuation for freelancers, because contributions can make things a little more complicated when filing taxes.)

5. File your tax claim when you’re ready

If you’ve gathered all the information you need, spoken with a tax professional, and considered all of your deduction possibilities, then there’s only one thing left to do—file your taxes!

If you haven’t filed taxes as a freelancer or sole trader, it’s not terribly different from how you would do it normally. You still file through the ATO’s portal, and simply fill out all of the tax information requested as you go. This should be pretty easy now that you’ve already gathered all of the required info.

Hopefully, if you properly estimated and filed your PAYG instalments over the year, there shouldn’t be too many surprises when you file. If you had a significant increase or decrease in your income toward the end of the year, you may have to pay a little more in taxes or you might receive a refund.

6. Plan ahead to make next EOFY even easier

Hopefully, this year’s filing wasn’t too stressful, but if it was, there are certain actions you can take now to ensure that you are ahead of the game for next year. Here are some quick recommendations:

Take advantage of Rounded’s accounting software to make it easy to track expenses and income all year long. You can try a free 14-day trial here.

Make sure you use a business bank account for your business expenses—this makes it much easier to keep track of your deductions.

Pay close attention to your PAYG instalments, and make sure you are paying the correct amount to avoid any surprises at the end of the year.

Consider hiring a tax accountant, so they can help keep you on track from the very beginning of the financial year to the end.

Contents

- Introduction

- 1. Know your EOFY dates and the basics

- 2. Pull together all of the information you need

- 3. Make sure you’ve deducted everything you can

- 4. Decide if you want to bring forward expenditures, or make donations or super contributions

- 5. File your tax claim when you’re ready

- 6. Plan ahead to make next EOFY even easier

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.