The freelancer’s guide to a Business Activity Statement (BAS)

If you’re a freelancer registered for GST, then you will probably need to submit a business activity statement, or BAS, to the ATO each quarter. This article covers what you need to know to file your BAS.

Article contents

− +-p-1600.jpeg)

There’s a lot to wrap your head around when you’re just starting out as a freelancer, from GST to ABNs to sole trader taxes. Fortunately, once you understand how to do it, lodging your BAS is simple—especially for Rounded users.

In this article, we’ll explain everything you need to know about BAS lodgment, including how to find the right figures, fill out the form, and when to submit it to the Australian Tax Office (ATO).

For more tips on starting up as a freelancer, be sure to check out these resources:

What is a business activity statement?

In short, a BAS is a form registered businesses must submit to the Australian Tax Office summarising all of your Goods and Services Tax (GST) activity over a period of time.

For those who are still unfamiliar with GST, check out our explainer article which outlines everything freelancers need to know about Goods and Services Tax.

For most sole traders (with a turnover of less than $10m), you generally report GST using the default Simpler BAS reporting method. The Simpler BAS method shows the GST you charged to your customers, as well as the GST you paid on your business-related expenses. Typically, this information must be submitted each quarter.

There are a few exceptions to the rule, depending on how much income you make:

Sole traders who voluntarily register for GST, but are making less than $75,000 a year in GST turnover, may submit their BAS annually

Businesses making $10 million or more in turnover may need to use the full reporting method. This format requires you to submit everything needed on the simpler BAS, as well as other information like export sales and capital or non-capital purchases.

If you’re unsure, chat to your accountant or the ATO who will be able to provide advice based on your specific circumstances.

How to lodge your BAS

Lodging your BAS is pretty easy—and using Rounded account, will significantly speed up the process. You can post a form to the ATO, but it’s much easier to lodge online.

The first step is creating getting an ABN for your business and determining whether you need to register for GST. Our full article on GST explains in more detail, but essentially, any business expecting to make $75,000 or more in a financial year is obligated to register and begin charging GST to their Australian clients. There are also instances where GST may need to be included in invoices sent to international clients - talk to your accountant or the ATO to find out what’s appropriate for your business.

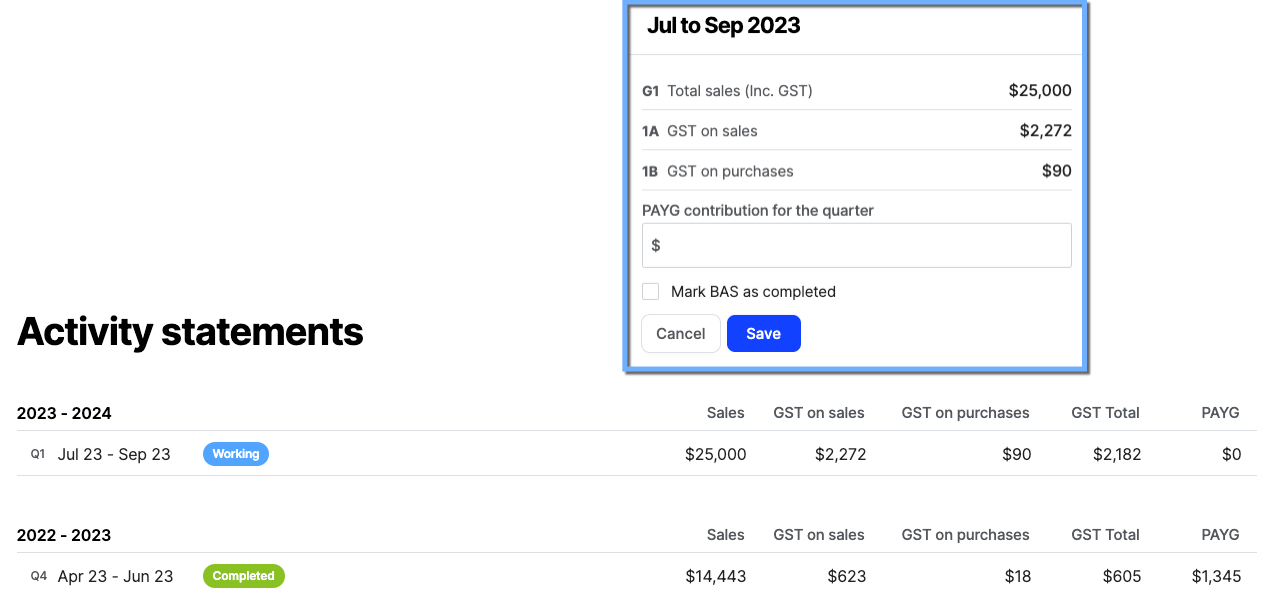

Reminder for Rounded users: Rounded automatically tracks GST on income and expenses. You’ll be able to get all information you need to lodge your BAS each quarter by running an Activity Statement which is found in the reports section.

Simpler BAS requires you to submit three pieces of information:

The total earnings for your business over the quarter (G1)

The GST charged to clients over the quarter (1A)

The GST you paid on business expenses over the quarter (1B)

Once you have these numbers, you can fill out the form and submit a payment via the portal. The amount you pay is the GST you charged to clients minus the GST you paid for your business expenses - in the event you paid out more GST than you collected you could be eligible for a GST refund.

That’s why it’s always a good idea to transfer the GST you collect from clients and customers in a dedicated business banking account. Here’s our guide on how to choose the best business banking account for your needs.

How to calculate your BAS

If you’re a Rounded user, the app will automatically track all incoming and outgoing GST based on the income and expenses you add for each quarter.

Simply pull the relevant Activity Statement for the quarter, and you’ll see the 3 numbers you need - G1, 1A and 1B.

Assuming your income and expenses have been correctly added for the quarter, (this may be where you might need some assistance from an accountant or bookkeeper to double check things) you’ll have everything you need to lodge your BAS via the ATO portal.

If you aren’t using Rounded for invoicing and tracking your finances, you could use a spreadsheet to keep track of this information. No matter what accounting system you use, it’s important all your expenses and income for the quarter are entered correctly.

BAS due dates for each quarter

The ATO will send you an alert via the MyGov portal before you need to make payments. You can also activate reminders from Rounded, but it’s still a good idea to mark down these BAS due dates.

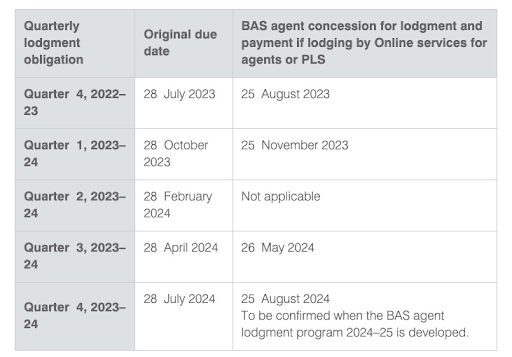

Using an accountant or registered BAS agent means in some cases payment deadlines are extended by approximately a month. There are some exceptions which are shown in the table below:

Quarter 1

Due date: October 28th

Period: July - September

Quarter 2

Due date: February 28th

Period: October - December

Quarter 3

Due date: April 28th

Period: January - March

Quarter 4

Due date: July 28th

Period: April - June

What if you can’t submit your BAS?

If there’s a legitimate reason why you can’t submit your BAS on time or at all for a given quarter, you may be able to apply for a BAS deferral. This will give you extra time to submit your BAS, without incurring a fine.

The ATO only provides deferrals for “exceptional or unforeseen” circumstances, and these can only be lodged by certified tax agents. The ATO doesn’t provide specifics on what events would fall into this category, but you can learn more about BAS deferrals here on the ATO website.

That wraps up everything you need to know about BAS payments as a freelancer. It’s a simple process, and using Rounded means the process can be quicker, cheaper and less stressful.

For more tips and advice on how to make the most of your freelance career, check out our blog.

Join newsletter

ABOUT ROUNDED

Invoicing and accounting software for sole traders. Get paid faster and relax at tax time.

-p-1600.jpeg)