-p-1600.jpeg)

Freelancer finances

End of Financial Year checklist for freelancers and sole traders

End of financial year doesn’t have to be stressful—it just takes a little planning and preparation. Here’s everything freelancers need to do to wrap up their financial year with no loose ends.

-p-1600.jpeg)

Business growth

How to make a freelance portfolio (with examples)

As your freelance career progresses, you’ll have a history of successful projects under your belt. Here’s how to turn these projects into a digital portfolio that will help you gain more customers and grow your business.

-p-1600.jpeg)

Business growth

How to use case studies to boost sales and grow your business

When you’re running your own business, one of the best ways to convert new customers and clients is by showing them evidence of your work. In this interview with Anfernee Chansamooth, you’ll learn how to create a case study that demonstrates your worth to your audience.

Business growth

How to develop a standout USP and use it to boost your business

One of the most important parts of running your own business is standing out from the crowd. Developing a unique selling point will separate you from your competitors and help your business thrive.

-p-1600-(1).jpeg)

Your career

Ready to start working for yourself? Ask yourself these 7 questions

If you’re getting serious about working for yourself, it’s natural to feel some trepidation. We put together seven questions you can ask yourself to know if you’re ready to make the dream a reality.

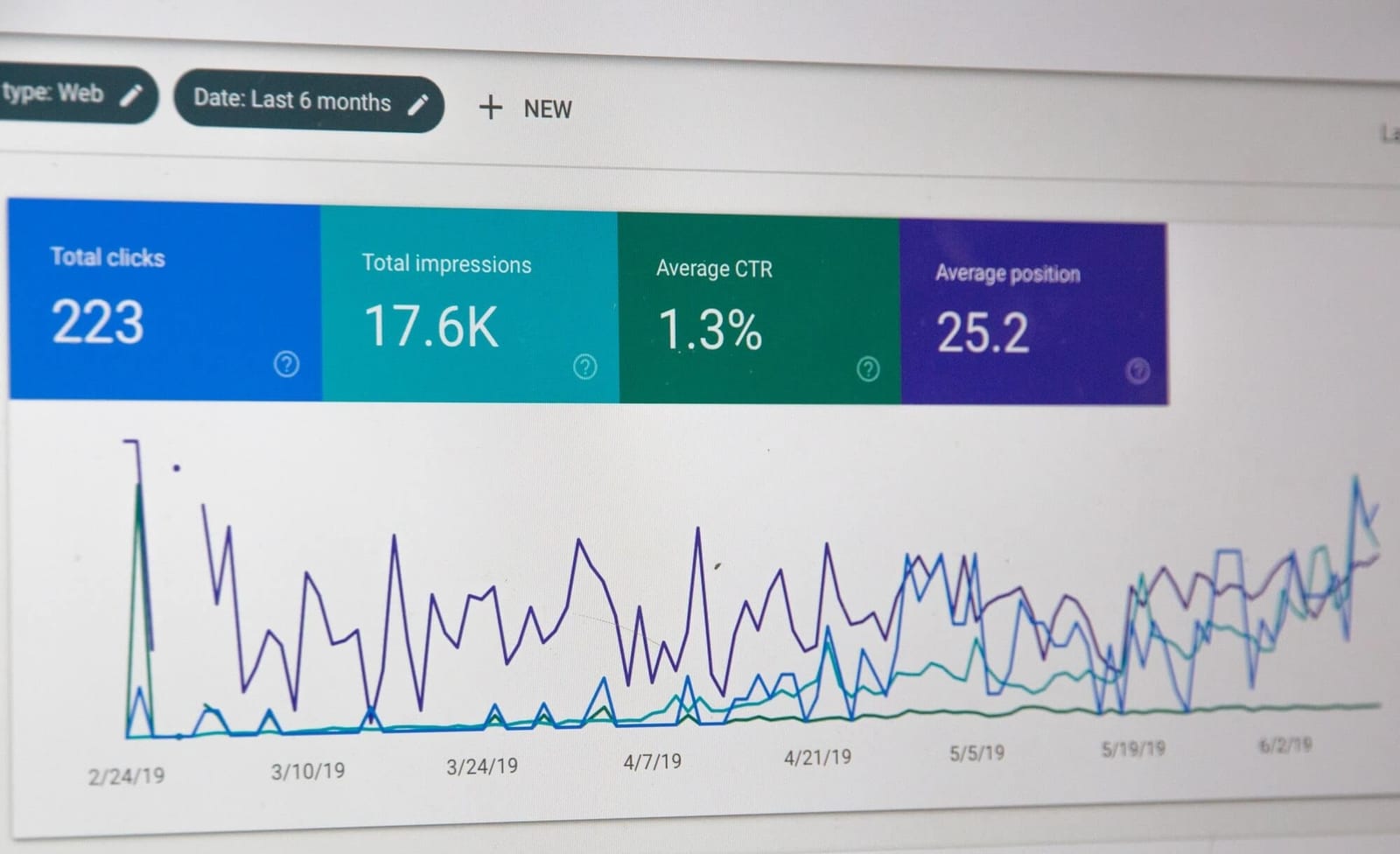

Business growth

SEO strategies freelancers can use to bring in new business

Your visibility on search engines like Google can make it much easier to bring in new leads, but its hard to outrank your competitors. In this Freelance Legends episode, we speak with SEO expert Liam Carnahan about the strategies sole traders can use to bring in more organic traffic.